A contra asset account is not classified as an asset, since it does not represent long-term value, nor is it classified as a liability, since it does not represent a future obligation. Contra liability, equity, and revenue accounts have natural debit balances. These three types of contra accounts are used to reduce liabilities, equity, and revenue which all have natural credit balances.

What are Contra Accounts?

Understanding COGS allows businesses to accurately assess their gross profit, inventory valuation, and net income. By implementing best practices and utilizing actionable tips, companies can ensure accurate COGS calculations and make informed decisions to improve cost management and profitability. Direct labor costs are the wages paid to those employees who spend all their time working directly on the product being manufactured. Indirect labor costs are the wages paid to other factory employees involved in production. Costs of payroll taxes and fringe benefits are generally included in labor costs, but may be treated as overhead costs.

Sales returns and allowances:

- The other method for writing off inventory is known as the allowance method.

- Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

- So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited.

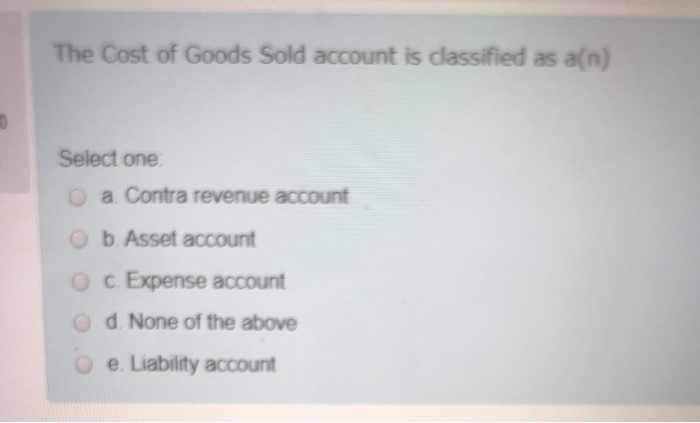

- A contra revenue account is a revenue account that is expected to have a debit balance (instead of the usual credit balance).

- But even a simplebase is sufficient in Internal Accounting to provide a reliable and practicalreport.

- Cost of goods sold is the direct cost incurred in the production of any goods or services.

Operating expenses include utilities, rent, office supplies, sales and marketing, legal costs, insurance, and payroll. The average cost is the total inventory purchased in the second quarter, $8,650, divided by the total inventory count from the quarter, 1000, for an average cost of $8.65. When the company multiplies the average cost per item by the final inventory, it gives them a value for the cost of goods available for sale at that point. Lowering COGS is one way to increase the gross profit of your company since COGS are variable costs.

Trial Balance

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. While this may entail a higher initial investment, it can pay off in the long run by reducing your overall costs. With the same selling price of bath soap, this helps your company increase your margin without jeopardizing quality.

How to Create a Cost of Goods Sold Journal Entry

A key example of contra liabilities includes discounts on notes or bonds payable. Contra liability accounts are not as popular as contra asset accounts. The sales discounts contra revenue account records the discounts given to customers on sales made to them, normally a cash or settlement discount. The account is normally a debit balance and in use is offset against the revenue account which is normally a credit balance.

What is a Contra Revenue Account?

A business will record a journal entry with a credit to a contra asset account, such as inventory reserve or the allowance for obsolete inventory. The most common contra account is the accumulated depreciation account, which offsets the fixed asset account. Taken together, the asset account and contra asset account reveal the net amount of fixed assets still remaining.

On Feb 5, journal entry to record the sales return and the buyer’s account adjustment. Once sales are made, not only sale revenue and account receivable are affected by this transaction. The goods will deliver to the customer, and the inventories will reduce. On 2nd Feb 2020, the firm recorded credit sales of 10 pieces for product Y and 15 pieces for product Z to one of its old customers for $50 and $25 each respectively. The average cost method uses a basic average of all similar items in the inventory, regardless of purchase date.

Cost of goods sold is the direct cost incurred in the production of any goods or services. LIFO is where the latest goods added to the inventory are sold first. During periods of rising prices, is cost of goods sold a contra account goods with higher costs are sold first, leading to a higher COGS amount. Retained earnings provide an ongoing picture of how much profit a company has been able to maintain without depletion.